An income property is any real estate you rent out to earn money, plain and simple. And here in The Bahamas, we’ve seen an increasing number of buyers interested in investing in rental properties.

There’s a strong rental demand, thanks to year-round tourism, with a record 11.22 million international visitors in 2024, and many tax-friendly laws. So the rental market in our country has a lot going for it. But finding the right income property takes more than just browsing listings.

We’ve helped all kinds of investors, from first-time buyers to seasoned investors, and even individuals who simply want a vacation home that pays for itself. In this guide, we’ll walk you through what to look for, where to buy, and how to get the best bang for your money.

TL;DR: How to Find Income-Producing Property in The Bahamas

-

Define your investment goals (short-term vs. long-term rental, personal use, passive income, etc.)

-

Choose the right location based on your rental strategy

-

Understand legal and permit requirements for foreign buyers and rental properties

-

Explore financing options and factor in total purchase and ownership costs

-

Calculate expected rental yield and return on investment

-

Partner with local property managers for hands-off ownership

-

Consider condo-hotel properties for truly passive rental income

-

Prepare for weather, upkeep, and seasonal shifts with proper planning and insurance

Step‑by‑Step: How to Find the Right Income Property

We don’t just start by showing you listings. When someone comes to us looking to invest, we take time to understand what they’re really after, what kind of returns they want, how involved they want to be, and what fits their lifestyle and budget.

There’s a method to this. And it works because we’ve done it so many times before.

1. Define Your Investment Goals and Budget

We begin by helping our clients figure out what they want this investment to do. Are they hoping to:

-

Rent short‑term to tourists for higher nightly income?

-

Rent long‑term for steady, lower‑maintenance returns?

-

Use the property part‑time and rent it out the rest of the year?

Each strategy has pros and cons. Choosing between short-term (vacation) and long-term rentals means balancing yield, workload, and lifestyle preferences. Here are some points to keep in mind:

|

|

Short-Term Rentals |

Long-Term Rentals |

|

Positives |

Higher nightly rates and income Personal use flexibility |

Steady income Lower day-to-day involvement |

|

Considerations |

More turnover Cleaning Utilities Guest support required |

Lower rental yield Less flexible use (rent for six months to a year at a time) |

|

Ideal For |

Owners who want to enjoy the property occasionally and earn high returns |

Passive investors looking for simplicity |

Short-term rentals can bring in more income, but they require more hands-on work or a property manager. Long-term rentals offer stability but may generate less income each month.

As an investor, it’s for you to decide if you want to do the high reward/high input short-term rental or a lower yield/less work long-term rental.

For example, we had a client who purchased a home in Treasure Cove for $380,000 and rents it long-term for $3,800/month. With low HOA fees of $145.20/month, that works out to a strong yield and minimal hassle. It’s ideal for someone looking for steady returns without managing short-term guests.

One reason many choose short-term is so that they, too, can enjoy the unit when they’re in the country. This option is very popular with snowbirds, for example.

Explore rental properties in Treasure Cove

2. Choose the Best Locations

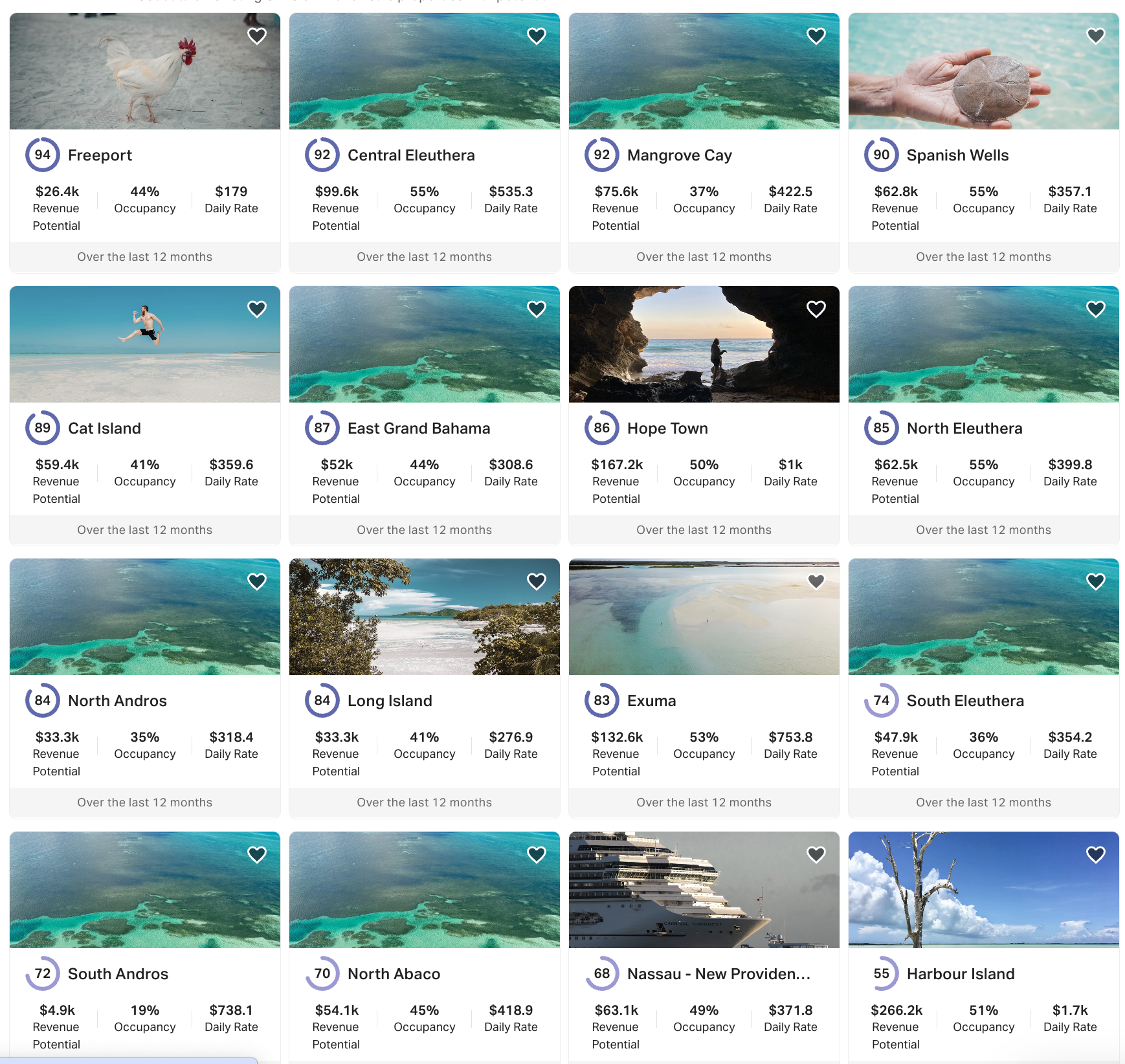

If you’re looking at short‑term rentals, occupancy and nightly rate matter more than just the view. According to recent AirDNA data, these destinations stood out for revenue potential and steady booking rates:

|

Location |

Occupancy |

Daily Rate |

Revenue Potential |

|

Harbour Island |

51% |

$1,016 |

$266,200 |

|

Hope Town (Abaco) |

50% |

$1,000 |

$167,200 |

|

Exuma |

53% |

$753 |

$132,600 |

|

North Eleuthera |

55% |

$400 |

$62,500 |

|

Spanish Wells |

55% |

$357 |

$62,800 |

|

Nassau / New Providence |

49% |

$371 |

$63,100 |

You’ll notice that smaller, boutique destinations like Harbour Island and Hope Town command much higher nightly rates, while Nassau/New Providence offers more consistent, year-round traffic, since it’s the capital of The Bahamas.

Want to geek out on the full chart? Here’s the actual data snapshot from AirDNA.

Let your goals shape where you look. For long-term tenants, proximity to schools, grocery stores, and healthcare facilities is more important, while for consistent short-term rental traffic, staying near beaches and attractions is preferable.

For example, Palm Cay is a gated waterfront community in Nassau. It’s tailor-made for short-term rentals, with a marina, pools, and on-site dining. Units here are in high demand and very active on Airbnb and Vrbo. Many owners are earning gross rental incomes close to 10% of their property value, thanks to consistent tourist traffic and strong nightly rates.

Explore rental properties in The Bahamas

3. Understand Legal and Permit Requirements

Buying and renting property in The Bahamas is very doable for foreigners, but there are a few legal steps you’ll need to follow. Here’s how we guide our clients through it:

Legalities Related to Buying Property in The Bahamas

Here’s what you’ll need:

Approval from the Foreign Investment Board, aka Bahamas Investment Authority (BIA): You’ll need this if

- You’re purchasing more than 2 acres, or

- The property is intended for commercial use, including vacation rentals.

Approval through BIA is a standard part of the due diligence process for non-residents.

Value-Added Tax (VAT): It’s paid on legal and conveyance fees, typically 10% of the property value. Exact costs can vary based on your deal structure, so it’s smart to consult with a local real estate attorney early.

Title Search and Legal Process: A licensed Bahamian attorney will

- Conduct a title search to ensure the property is free of liens

- Draft the purchase agreement

- Handle the conveyance and registration in your name

We often work with Mitre Court, a reputable local law firm that specialises in commercial real estate matters.

Legalities to Know When Renting Out Your Property

The legal processes and permits vary depending on the duration for which you wish to rent out your property.

Short-Term Rentals: If you plan to rent your property on a short-term basis (e.g., via Airbnb or Vrbo), you must follow these rules. These rules apply to all vacation rentals in The Bahamas, even if you own a condo or small unit.

- Apply for a rental permit through the Investments Board

- Register with the Department of Inland Revenue

- Obtain a business license

- Collect and remit 10% VAT

Long-Term Rentals: If you’re renting for 45 days or more (under 5 years), you do not need a permit and are exempt from VAT, even if you rent out multiple properties. But you may still want a formal lease agreement and local legal support to protect your interests.

4. Explore Financing and Costs

Most income property buyers in The Bahamas pay cash. It’s the simplest and fastest way, especially for overseas investors.

But if you’re looking at financing, here’s what to know:

Local Bank Financing: Some Bahamian banks do offer mortgages to non-residents, but expect:

- 30-40% down payment

- Proof of income and bank references

- Legal and bank fees that can add 10-12% to your total cost

The process takes longer than cash deals, so plan accordingly. We work with a network of local lenders who are experienced in helping expat buyers get approved.

Some buyers refinance property in their home country to access cash and avoid the Bahamian loan processes altogether.

Other Costs to Budget For: Even if you pay cash, keep in mind:

- Legal fees and stamp duty (usually split with the seller)

- Property insurance

- Maintenance and management fees

- HOA fees, if you’re buying in a gated community or condo development

Knowing these costs upfront helps you evaluate your actual return and avoid surprises later. Here are the details of the costs and fees associated with the sale and purchase of a property.

5. Calculate Rental Yields

We aim for a net yield of 8% or higher for short‑term rentals. Rental yield of long-term rentals may be lower, but they also have lower turnover rates. When you’re buying a rental property, you don’t need to guess. You can easily calculate the expected rental yield of your income property.

Here’s the basic formula:

We’ve calculated the expected rental yield of some of the popular communities and neighbourhoods in Nassau, using our own market data.

|

Area/Community |

Avg. Sale Price |

Avg. Rental Price |

Gross Rental Yield* |

Property Types |

Buyer/Renter Profiles |

|

Sandyport |

$1,036,555.56 |

$7,181.25 |

8.31% |

Single Family Homes Canal-Front Homes Townhouses |

Expats Familes |

|

Delaporte |

$536,250 |

$3,637.50 |

8.14% |

Oceanfront condos Townhomes |

Professionals Second-home buyers |

|

Cable Beach |

$536,250 |

$3,637.50 |

8.14% |

Condos, townhomes |

Expats Snowbirds |

|

Port New Providence |

$2,995,000 |

$4,750 |

1.90% |

Waterfront homes |

Boaters Long-term expats |

|

Eastern Road |

$1,098,133.33 |

$3,376.32 |

3.69% |

Older large homes Single- and Multi-family homes |

Locals Families |

|

Treasure Cove |

$661,600 |

$4,500 |

8.17% |

Single-family homes Beachfront homes |

Families Expats Retirees |

|

Old Fort |

$9,057,500 |

$45,000 |

5.96% |

Waterfront estates Townhomes |

Families Expats Retirees |

|

West Bay Street |

$565,000 |

$3,250 |

6.91% |

Single- and Multi-family homes Oceanfront homes Townhomes Condos |

Professionals Families Expats Retirees |

*Yields shown are gross estimates based on average sale and rental prices. Actual returns will vary based on management, expenses, and occupancy.

Managing and Maximising Rental Income

Smart ownership doesn’t end at purchase. It begins there. You need to think carefully and take deliberate steps to turn your rentals into a reliable income and enjoy seasonal perks.

Partnering with Property Managers

For overseas investors, property management is essential. We can connect you with vetted, experienced local teams who handle:

- Guest bookings, cleaning, and guest support

- Maintenance, landscaping, and HOA coordination

- Bookkeeping, reporting, and vendor relationships

Many gated communities (like Palm Cay or Treasure Cove) offer in-house rental programs. That means if you buy there and rentals are allowed, there’s already infrastructure in place to support your ownership, such as guest services, pool management, and maintenance, without requiring you to coordinate it all from afar.

Not All Ownership Is Hands-On

If you’d rather skip the rental hustle altogether, condo-hotel gems can offer a “set it and forget it” approach.

For example, at places like The Reef at Atlantis, Rosewood Residences at Baha Mar, or Grand Isle Resort in Exuma, owners receive 90 days of personal use per year, while the unit participates in a fully managed hotel rental program for the remainder of the time.

That means you don’t have to worry about any guest bookings or cleanings. You can just show up when you’re ready and enjoy the resort amenities at your own place.

This model is great if you want passive income with none of the legwork.

Explore luxury rentals in The Bahamas

Hurricane Safety and General Upkeep

The Bahamas is in the hurricane belt, and before it makes you sweat, here’s what it looks like on the ground:

- Since we understand hurricanes well, our modern homes are built to strong hurricane standards

- Insurance is available and widely used to protect both property and rental income

- Home inspections before purchase help ensure your property is structurally sound and up to code

Many buyers choose gated communities because these developments prioritise backup systems, drainage, and building integrity.

Regardless, island properties, particularly on the ocean or facing the sea, require special care. This isn’t a cause for alarm, though, as with proper care, your investment stays protected and profitable for years.

- Local property managers handle everything from landscaping to appliance repairs

- Regular maintenance and storm preparation routines help reduce long-term costs

- Insurance also helps cover unexpected wear or weather-related repairs

Seasonal Fluctuations

Unlike other destinations, The Bahamas sees year-round tourist activity. While the rainy season (typically Aug-Oct) brings a slight dip, visitors and income don’t stop. Properties close to the beach or main attractions stay booked even in the shoulder months.

Buying an income property in The Bahamas is a smart investment when done right. With the right location, strategy, and local support, you can earn steady returns and enjoy the perks of island living when you’re in the country.

If you’re ready to start the process (or even just curious), we’d love to chat. Our team is here to walk you through every step and help you turn your Bahamian dream into a smart income-generating reality.

Get in touch and let’s talk about what’s possible

FAQs

1. Can I own property in The Bahamas through a company or trust?

Yes, many foreign buyers use holding companies or trusts for estate planning or privacy. It’s essential to consult a local attorney to ensure the structure is properly in place.

2. How do I know if a community allows short-term rentals?

Rules vary by development. Some communities have HOA restrictions, while others actively support vacation rentals. We’ll help you check this up front before you make a purchase.

3. What happens if I want to sell my income property later?

You can sell at any time. There’s no capital gains tax, and we can assist with pricing, marketing, and legal steps to help you list your property successfully.

4. Can I rent out my property while applying for residency?

Yes. As long as your permits and licenses are in order, you can rent while your residency application is in process.

5. What type of insurance do I need for a rental property in The Bahamas?

You’ll typically want hurricane coverage, liability insurance, and property protection. Some policies also cover loss of rental income.

Posted by Helen Dupuch on

Leave A Comment